Game's Tips

How to play cashflow Game on PC?

How to play cashflow Game on PC

Introduction:

In the digital age, financial literacy has become a crucial skill, and what better way to enhance it than by playing the Electronic Cashflow game on your PC? This digital adaptation of the classic board game provides a dynamic and interactive experience, allowing players to navigate the complexities of personal finance in a virtual world. In this comprehensive guide, we will walk you through the steps to play the Electronic Cashflow game on your PC, exploring its features, strategies, and the digital nuances that make it a valuable tool for financial education.

Getting Started:

Download and Installation:

-

- Begin by visiting the official Electronic Cashflow game website or your preferred gaming platform.

- Follow the prompts to download and install the game on your PC.

Exploring the Digital Interface:

Dashboard Overview:

Once in the game, familiarize yourself with the digital dashboard. Key elements include your current financial status, assets, liabilities, and available opportunities.

The interface of the game is presented in the Fig 1. which is labeled from 1 to 8

① Choosing the single-player game mode

② Choosing cashflow 101 or 202

③ Choosing your dream

④ Choosing your character’s name

⑤ Income statement

- Sources of Income: The statement will list the various sources of income generated by the player during the game. This might include salary, business profits, rental income, and any other forms of revenue.

- Amounts: The total income is calculated by adding up all these sources. The game’s digital interface may provide visual representations, such as charts or graphs, to illustrate the composition of income.

⑥ Expenses

- Categories of Expenses: Expenses are categorized into various sections such as living expenses, loan payments, and other financial obligations. The game models real-life expenses that individuals encounter regularly.

- Amounts: The total expenses are calculated by adding up all the costs associated with living, investments, and any other financial commitments. The goal is to manage expenses wisely to maximize the surplus for investing and wealth-building activities.

⑦ Assets

- Definition:

- Assets are things you own that have monetary value. In the Electronic Cashflow game, assets represent investments, properties, and other valuable items that contribute to building wealth.

- Types of Assets:

- Real Estate: Properties and land that can generate rental income or appreciate in value.

- Businesses: Ownership of businesses that can generate profits.

- Stocks and Investments: Ownership of financial instruments that have the potential to increase in value.

- Intellectual Property: Ownership of patents, trademarks, or other intellectual assets.

- Income Generation:

- Assets in the game are designed to generate passive income. Players strategically acquire assets to increase their cash flow, helping them move closer to escaping the Rat Race.

- Wealth-Building:

- The accumulation of assets is a key strategy for building wealth. Players aim to invest in income-generating assets to achieve financial freedom.

- Value Appreciation:

- Certain assets may appreciate in value over time, providing players with the opportunity for capital gains when they choose to sell or divest.

⑧ Liabilities

- Definition:

- Liabilities are financial obligations or debts that you owe. In the game, liabilities represent loans, credit card debt, and other financial commitments.

- Types of Liabilities:

- Mortgages and Loans: Debt incurred to acquire assets such as real estate or businesses.

- Credit Card Debt: Unpaid balances on credit cards.

- Other Financial Obligations: Any form of financial commitment that requires repayment.

- Expense Generation:

- Liabilities often result in regular expenses, as players must allocate funds to repay loans and cover interest charges.

- Debt Management:

- Effectively managing and reducing liabilities is a key aspect of financial strategy. Players aim to minimize debt to free up resources for wealth-building activities.

- Risk Mitigation:

- Accumulating too many liabilities can pose a risk to financial stability. Players need to carefully manage their debt levels to avoid financial setbacks.

Navigating the Game Mechanics:

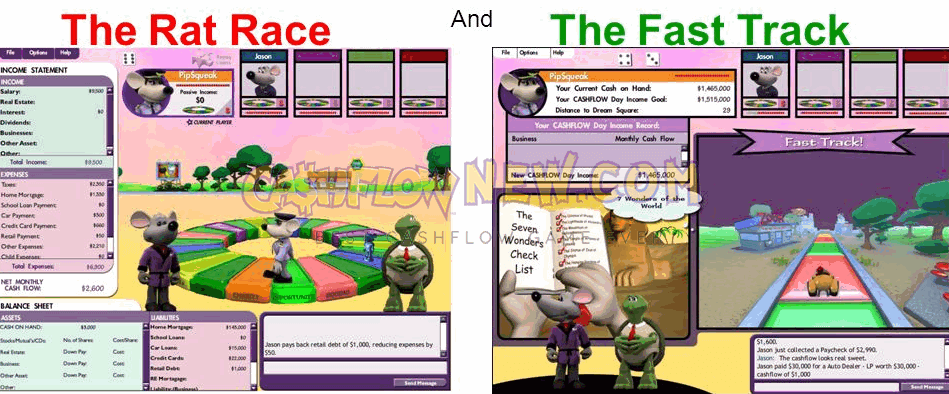

Interactive Rat Race and Fast Track:

-

- Explore the digital representations of the Rat Race and Fast Track. Understand the nuances of each path and strategize to make progress.

Digital Cards:

-

- Dive into the interactive world of digital cards that simulate real-life events. React wisely to challenges and opportunities to advance in the game.

Digital Doodads and Assets:

-

- Learn to distinguish between digital doodads and assets. Invest in assets that generate income while avoiding unnecessary expenses.

Winning Strategies:

Digital Investments:

-

- Utilize the digital investment options available, such as stocks, real estate, and businesses. Understand the risks and rewards associated with each.

Digital Cashflow Sheets:

-

- Manage your digital cash flow sheet effectively. Regularly review and adjust your budget to ensure financial stability.

Tips for Success:

Online Networking:

Take advantage of the online networking features. Interact with other players, share insights, and explore collaborative opportunities.

Adapt and Learn Digitally:

Embrace the dynamic nature of the digital game. Adapt your strategy based on changing circumstances and continuously learn from your digital financial journey.

Winning the Digital Game:

Escaping the Digital Rat Race:

Strive to be the first player to escape the digital Rat Race. This involves achieving a specific level of passive income and minimizing expenses.

Victory Celebration:

Celebrate your digital financial freedom with in-game festivities. Revel in the success of mastering the Electronic Cashflow game.

Additional Digital Resources:

In-Game Tutorials and Help:

Explore the in-game tutorials and help section to deepen your understanding of the game mechanics. Use these resources to enhance your financial knowledge.

Conclusion:

In conclusion, playing the Electronic Cashflow game on your PC offers a unique and engaging way to develop financial literacy. From mastering the digital interface to implementing winning strategies, the game provides a holistic experience that mirrors real-world financial challenges. Embrace the journey, learn from your digital financial decisions, and celebrate the victories along the way. The Electronic Cashflow game on PC isn’t just a game; it’s a valuable tool for honing the skills needed for financial success in the real world.